Cirsa IPO - The Boring but Cash Cow Business Overview

- Jun 26, 2025

- 6 min read

Business Overview –The Spain + Latam Gaming Omnichannel Play

Casinos: This includes all traditional casinos and gaming halls (including bingo halls and slot arcades) operated by Cirsa across Spain, Latin America, and Morocco. The Casino segment generated €988m of revenue and €406m of EBITDA (41% margin) in FY24

Slots in Spain. The slot segment encompasses Cirsa’s operations of slot machines in Spain’s bars and arcades (the bar “route” market), as well as Cirsa’s B2B slot manufacturing business for the Spanish market . To draw similarities, the slot business is similar to the cabinet industry in the U.S (e.g. HRMs by CHDN). Mgmt. believed they are the largest operator in Spain with 40k slot machines across Spanish bars. The Spain Slots segment generated €682m of revenue and €191m of EBITDA (28% margin) in FY24

Slots in Italy. Cirsa operates in Italy’s gaming market by running slot machines (AWP) and Video Lottery Terminals (VLT) in bars and gaming halls. The Italy market is generally challenging to operate in given high gaming taxes (aka lower machine yield) and a fragmented venue structure. Cirsa operates about 13.6k slots machines in Italy across 2.5k locations. The Italy Slot business generates €450m in revenue and €29m in EBITDA (6.3% margin) in FY24

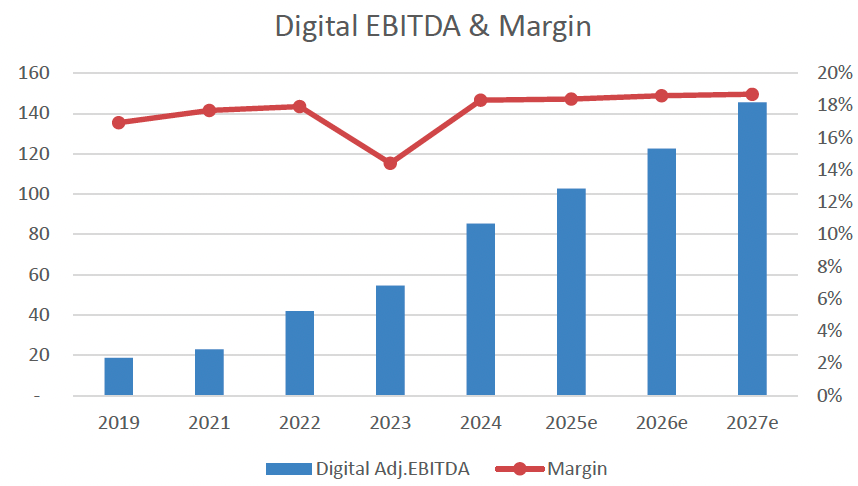

Digital Gaming. This includes Cirsa’s online sports betting and iGaming operations, primarily through the Sportium brand in Spain (and extensions in LatAm). The company entered into the digital business with Ladbrokes (Entain) in 2007 to focus on online sports betting. Cirsa acquired Ladbroke’s 50% stake in Sportium for € 70m in 2019. Sportium is in 8 markets in Spain, Italy and Latam. The digital segment generated €466m in revenue and €85m of EBITDA (18% margin) in FY24

Business Overview – Casino - A high-margin segment with strong FCF

Cirsa’s casino business remains the company’s largest and most profitable segment, serving as the primary engine of both revenue and EBITDA generation. Over the past several years, cash flow from this segment has supported investments in the digital business and funded the company’s expansion strategy across Latin America’s land-based gaming markets. The segment’s growth has been underpinned by a combination of organic performance and targeted M&A. Operational momentum has been strongest in Panama, Colombia, and Peru, where the company continues to see solid demand recovery and favorable market dynamics. Meanwhile, the Spanish casino market has delivered steady growth, supported by the company’s strong local presence and well-diversified asset base.

Gaming Taxes. Gaming taxes on this segment mostly correspond to taxes on machines, which are calculated based on a % of GGR, ranging from 4% to 18%. A minority portion of gaming taxes on this segment corresponds to fixed taxes on machines and tables, primarily related to Panama. Not surprisingly, the tax regime has changed in the last several years, particularly in Colombia (15-17% tax historically to 19% in 2025) and Peru (70bps increase in consumption tax, to 1% in 2025).

Tuck In M&A. Cirsa has historically pursued a tuck-in acquisition strategy to expand its casino footprint than greenfield developments. Key transactions include entry in Costa Rica in 2015 (7 casinos from Thunderbird Resort), Peru in 2017 (slots operations from Novomatic), DR (Casino Jaragua). We think the rationale makes sense as Latam markets are usually involved complex administrative process for gaming operations/licenses and buying a cluster of operations increases faster market entry and access to experienced local staff and operating infrastructure.

Regulatory Risk. Although Cirsa primarily operates in regulated Latin American markets, evolving regulatory landscapes pose potential threats to profitability. Recent developments include:

Panama Litigation on Gaming License in 2023 (Ongonig). In 2023, Cirsawas was sued by both Codere and Panama’s Gaming Control Board over allegations that it was operating more slot halls than permitted under its existing gaming license. The dispute centers on whether Cirsa exceeded the authorized number of locations by utilizing loopholes in license allocations. While the company maintains that its operations are within legal bounds, the case remains active and highlights the legal complexity and enforcement variability across jurisdictions in which Cirsa operates.

Mexico’s ban on retail bingo and gaming slots in 2023 (resolved). In 2023, the Mexican government introduced a proposal aimed at tightening control over land-based gaming. The draft regulation sought to prohibit retail bingo halls and slot machine operations, while also shortening the duration of gaming licenses from 25 years to 15 years. Ultimately, the regulation was overturned by the Supreme Court, largely due to constitutional challenges and lobbying from affected operators —including Cirsa

Business Overview – Slots

The Spanish slots business is relatively straightforward and consists of two key components:

B2C: To date, the company operates approximately 25,000 slot machines across 16,500 venues, primarily third-party bars and similar hospitality establishments. Similar to the casino business, the company also made acquisition to grow its segment. The most notable was the 2019 acquisition of Giga Game, which grew the company’s slot count by 23%. In general, these machines are owned by Cirsa and placed under five-year revenue-sharing agreements with local bar or venue owners, who provide floor space in exchange for a share of gaming revenue. In select cases, Cirsa also provides “key money” (e.g. upfront payments) to secure high-potential locations and support expansion. Given that gaming taxes and the payout per slot machine are regulated by Spanish law, the company has concentrated on identifying and obtaining attractive sites to place their slot machines and controlled operating costs through efficient management. As such, in the recent period, Cirsahas has begun strategically exiting underperforming venues in favor of optimizing slot yield.

B2B: Cirsa also operates a B2B business focused on the design, manufacturing, and sale of slot machines tailored specifically for the Spanish bar market. This is similar in structure to the slot supply businesses of Light & Wonder and IGT, although Cirsa’s offering is on a smaller scale and geographically concentrated in Spain

Slots Italy. The company owns 5 gaming halls in Italy as well as functions as a network system operator for slot machines and VLTs in Italy. In 2023, the company acquired Modena Giochi, a slot route operator, and added 3.8k slot machines to Cirsa’s portfolio. The Italian gaming industry has been bogged down by tighter advertising and higher taxes implemented by the Italian government. Since 2019, taxes have increased from 19.25% on slots and 6.25% on VLTs to 24%and 8.50%, respectively. Cirsa has been focusing on yield management and strategic consolidation (e.g. Modena Giochi) for greater economies of scale and to improve market positioning. This business is low margin (6%), and we believe Cirsa will continue to manage for yield

Business Overview –Digital Gaming

The Crown Jewel. Sportium is Cirsa's primary sports betting brand, focused predominantly on the Spanish market. Originally established in 2007 as a joint venture with UK-based bookmaker Ladbrokes, Sportium became fully owned by Cirsa in 2019 when it acquired Ladbrokes' 50% stake for 70m. Since then, the company has begun offering online gaming operations and Sports betting through outlets and betting machines in Spain, Colombia, Panama, and Peru. Recently, they have expanded into Italy with the acquisition of E-Play and in Mexico through the acquisition of GannaBet. Cirsa’s Sportium is the #1 sports betting operator in Spain’s retail channel, and it also offers online casino games; Sportium had over 2,150 retail points (betting shops/kiosks) in Spain. Depending on the region, gaming taxes range from 10% to 25%.

The Value Proposition. Unlike the U.S digital-only counterparts that primally focus on app-based interaction, Sportium combines both extensive physical retail presence as well as a growing digital presence. The hybrid approach provides multiple customer touchpoints, local market visibility and offers greater brand credibility and trust. For Cirsa, this approach creates higher barriers to entry for competitors and enables stronger cross-selling opportunities, particularly by converting existing retail slot hall customers into online sports betting and digital gaming users. Additionally, Spanish regulators tend to favor digital operators with a physical footprint, as it facilitates better oversight, regulatory compliance, and consumer protection.

The M&A Playbook. Since the full ownership of Sportium in 2019, Cirsa has aggressively expanded its digital presence through M&A. The most notable transactions include the €53m acquisition of E-Play (60% stake) in Italy and €20m acquisition of Ganabetin Mexico in 2022. These deals enabled Cirsato not only to double the size of its digital operations but also to enter two key regulated markets: Italy and Mexico. Building on this momentum, the company also broadened its international presence with the €198m acquisition of ApuestaTotal (Peru) and €28m acquisition of Casino Portugal in FY24.

Comments